Products

Feedback

Home >> news

China AM: Steel, iron ore futures fall on soaring yuan

China’s steel and iron ore futures fell during morning trading on Friday January 6 after the People’s Bank of China lifted its yuan fix to its highest level in a month.

Futures closing prices – morning session

|

Shanghai Futures Exchange

May rebar: 2,919 yuan ($423), down 29 yuan ($4.20)

May hot rolled coil: 3,304 yuan ($479), down 55 yuan ($8)

Dalian Commodity Exchange

May iron ore: 542 yuan ($79), down 7.50 yuan ($1.10)

May coking coal: 1,160.50 yuan ($168), up 12.50 yuan ($1.90)

May rebar: 2,919 yuan ($423), down 29 yuan ($4.20)

May hot rolled coil: 3,304 yuan ($479), down 55 yuan ($8)

Dalian Commodity Exchange

May iron ore: 542 yuan ($79), down 7.50 yuan ($1.10)

May coking coal: 1,160.50 yuan ($168), up 12.50 yuan ($1.90)

Billet

Tangshan billet prices: 2,790 yuan ($404) per tonne, unchanged as Thursday.

Raw materials

Western Australia’s Port of Port Hedland iron ore shipments reached an all-time high of 43.94 million tonnes in December, up 17% on the year. China took up 37.40 million tonnes, also the highest volume that it had ever received in single month.

Rio Tinto is offering 170,000 tonnes of 61% Fe Pilbara Blend fines, laycan February 1-10, via a tender that closes at 3pm.

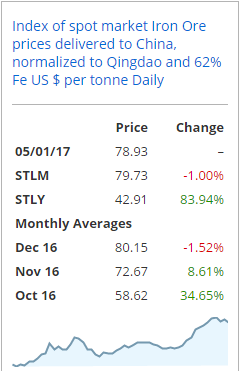

Metal Bulletin’s 62% Fe Iron Ore Index rose by $1.68 per tonne to $78.93 per tonne cfr China on Thursday.

Key market news

China’s central bank lifted the official midpoint for the yuan by 639 basis points to its highest level in a month, at 6.8668 against the dollar this morning.

Driven up by a rising cost of funds in Hong Kong, the offshore yuan soared for a second day overnight and traded at 6.7831 against the dollar at 4.45am on Friday, a 2.6% appreciation compared with two days ago.

Hebei province’s Tangshan city, China’s major steel production hub, aims to cut 9.33 million tpy of ironmaking capacity and 8.61 million tpy of crude steel capacity this year, local authorities said on Thursday.

In late December, Hebei’s provincial government disclosed that it aimed to cut 17.14 million tpy of crude steel capacity and 19.86 million tonnes of ironmaking capacity in 2017.

East Asia’s stainless steel market held steady over the past week with lower prices at the region’s major source China being offset by higher ex-works prices set by producers in Taiwan and South Korea.

Prices for February shipments of benchmark 304 stainless 2mm cold rolled coil were assessed at $2,220-2,250 per tonne cif East Asian ports on Friday, while those for 304 stainless steel hot rolled sheet were assessed at $2,120-2,140 per tonne cif East Asia.