Wall Street Overreacted to Cliffs Natural Resources' Third-Quarter Loss

There are a

couple things baked into the decline in earnings that make the numbers look a little worse than the

overall situation at the company. The first is that the company took a loss on the extinguishment of

some of its debts. This was one of those temporary hits that a company should take, because the payoff

lowered annual interest expense payments by $17 million annually, and it means that the next-term notes

due aren't until 2020. This gives the company lots of time to improve its profitability before any more

debts come due.

Another thing that lowered earnings this quarter

were some costs at its U.S. Iron Ore operations related to the restart of one of its United Taconite mines.

These costs will likely be worth it, as Cliffs anticipates it will need production to meet increasing demand

in 2017.

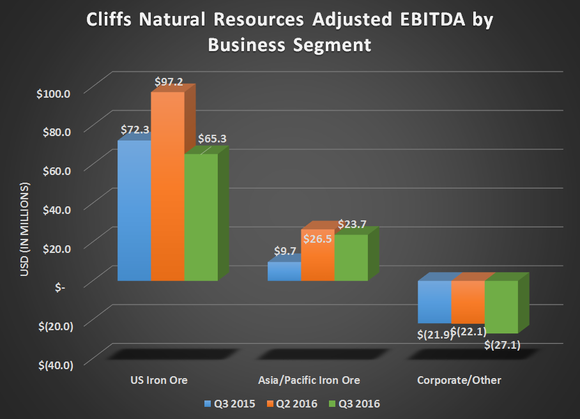

EBITDA = EARNINGS BEFORE INTEREST, TAXES,

DEPRECIATION, AND AMORTIZATION. DATA SOURCE: CLIFFS NATURAL RESOURCES EARNINGS RELEASES. CHART BY

AUTHOR.

The news that should be encouraging to investors

is that the company is increasing its sales guidance for 2017. According to management, customer demand has

already fully subscribed to its annual production levels, and it will likely draw down on iron-ore

inventories.

Management's path forward

When CEO Lourenco Goncalves was brought on to run

Cliffs a few years ago, the company was in rough shape. It had an extremely bloated balance sheet and a

bunch of unprofitable assets that were dragging down the business. These past couple years, Goncalves has

shed these assets and has reduced the company's debt load. With much of that work having an impact on the

bottom line, Goncalves highlighted where he sees the company going from here:

For two years, we have been in the process of

tackling the many pressing issues we have faced: volume uncertainty, competitive threats within the Great

Lakes, loss-making non-core assets, Bloom Lake, a bloated cost structure, and a near-term debt maturity is

tearing us in the face. We have moved past all of these problems.

So a question we are getting more often is,

what's next? Well, let me lay out what we now have in front of us. On the financial side, we have done a lot

to reduce debt, clearing over $1.1 billion over the last two years despite minimal cash flow generation. Now

just imagine what we can do next year, when we're actually generating free cash. We want to make our balance

sheet bulletproof to withstand the cyclical downturns that are so common in this industry. And to get to

that point, we still have more work to do. With that in mind, debt reduction and maturity extinction remain

our top capital-allocation priorities. To the extent we do generate free cash flow in the future, we expect

to be deployed toward these goals.

On the strategic side, we acknowledge that the

electric-arc furnace mills account for nearly two-thirds of steel production in this country. In order for

Cliffs to be around for another 100 years, we need to evolve to the point that we are supplying and actively

involved with the EAF side of the business.

The point about electric-arc furnaces and their

future in the American market can't be overstated. Not only do these types of furnaces figure in a large

majority of the steelmaking process in the U.S., they are also a much more profitable method of making

steel. The companies that use traditional blast furnaces have been barely treading water these past five

years, while those companies that focus exclusively on electric-arc furnaces have remained mostly profitable

this whole time.

What a Fool

believes

Cliffs will likely need to incur some capital

costs to upgrade its iron-ore pellets such that they are suitable for electric-arc furnaces. In the long

run, though, this is clearly the direction the company needs to move if it wants to supply American steel

producers, because it's where the industry is heading.

This negative turn in earnings for the quarter

was a bit of a bummer, but some of the reasons for that slide look to be temporary. Things are certainly

looking up, as the company plans to increase production and draw down inventories in 2017. If Cliffs can

continue to keep its costs low, then investors should expect a return to profitability, as well as further

extinguishment of debt that will make the company much better positioned to withstand the ups and downs of

the commodity market. All this seems to suggest that investors shouldn't take Cliffs' big stock slide after

earnings as a bad sign.

10 stocks we like better than Cliffs

Natural Resources

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the

newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the

market.*

David and Tom just revealed what they believe are

the ten best stocks for investors to buy right now… and Cliffs

Natural Resources wasn't one of them! That's right -- they think these 10 stocks are even better

buys.